|

EFES NEWSLETTER - JANUARY 2026

|

Great

Britain

– The rise and sabotage of employee ownership

in SMEs

|

|

Over

the past ten years, employee ownership in SMEs has seen

extraordinary growth in Great Britain. We were rapidly

moving towards a situation where one in ten SMEs would

be employee-owned. In most cases, employees become 100%

owners of their company. Without having to spend a single

penny of their own money. This success was due to the

introduction of the Employee Ownership Trust

mechanism in 2014.

And then... on the basis of haphazard figures and in

the name of an outdated ideology, the new British government

chose to tax and re-tax business transfers. As of 26

November, the tax exemption on capital gains relating

to the sale of a company to employees has been halved.

The effect is dramatic. Overnight, business transfers

to employees in Great Britain ground to a halt.

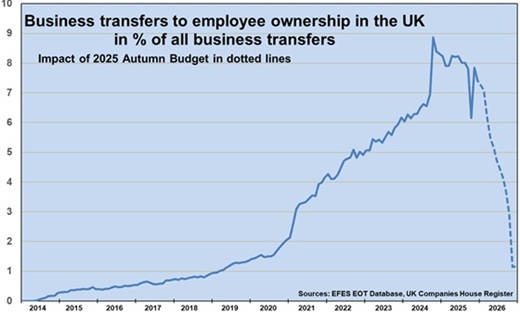

The graph below shows that, of every hundred businesses

transferred today, eight are passed on to employees.

The prediction model (dotted line) indicates that this

figure will drop to close to zero by the end of this

year if the decision is not corrected. There is only

one way to avert disaster. It is essential to reinstate

the 100% exemption on capital gains relating to the

sale of a company to employees.

More

info

|

|

|

|

Denmark - A counterexample

|

|

Today, we know that business transfers to employees

are possible on a large scale, without employees having

to invest a single cent of their own money.

For this to work, two technical conditions are required:

1. The

mechanism is that of collective employee ownership,

embodied in a legal vehicle of the trust type.

2. The

owners should be 100% exempt from capital gains tax

on the sale of the company to employees.

Instead of trying to replicate the conditions for success

that have proven effective elsewhere, the Danish legislator

has opted for an original national approach. The law

was passed by the Danish Parliament on 19 December.

Have the two conditions for success been met? No!

Instead of a trust, the legal vehicle intended to represent

the employees is a capital company or cooperative, with

no tax exemption for the sale of the company to the

employees.

This is a twofold error - the Danish mechanism will

not work.

|

Press

review

A

selection of 26 remarkable articles in 8 countries in December

2025: Canada, Czechia, Denmark, France, Italy, Slovenia, UK,

USA.

Canada:

Employee Ownership Trusts in Canadian style.

Czechia: The new law on employee share plans comes

into effect on January 1st.

Denmark: The law on business transfers to employees

was passed on December 19th.

France: New employee share plans for Axa and for Spie.

Employee buyouts in haphazard fashion.

Italy: New employee share plans for Eni and for Stellantis.

Slovenia: The new employee ownership model is the most

successful in the world.

UK: Following the Labour government's decision, employee

buyouts have been halted. The reactions are generally reassuring

and soothing – it'll be alright, my friend.

Perhaps for the last time in this column (all these press

reports being prior to the government decision): Thanks to

the Employee Ownership Trust formula, two new SMEs are transferred

to their employees every day now. This time, among others,

the cases of: Penny Engineering, Advanced Plastics, Mike Whitfield

Construction, Adder Technology, Contractor, Kinase Digital,

Artemis Marketing, Berry’s Coaches.

USA: Avis Alaska now 100 percent employee-owned.

Guidon pioneers Employee Ownership Trust in Indiana.

The full press review is available

on:

https://www.efesonline.org/PRESS

REVIEW/2025/December.htm

|

A

political roadmap for employee ownership in Europe

A

political roadmap for employee ownership in Europe

The

EFES needs more members. Download the EFES membership form

The

EFES needs more members. Download the EFES membership form

What's

new on the EFES website?

What's

new on the EFES website?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|