|

EFES HÍREK - 2021. JANUÁR

|

Employee share ownership in SMEs – Great Britain's

success

|

|

It

is well known that the transfer of a company represents

the most favourable moment in time and the most efficient

operation for multiplying employee share ownership in

SMEs.

This

is what convinced the USA to implement the ESOP technique

in 1974. In

Europe, the first country to act in the same direction

was Great Britain, with the launch of the Employee Ownership

Trust (EOT) formula in April 2014.

Question:

Is it a success?

-

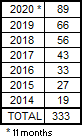

From 19 transfers in 2014, it rose to 27 in 2015,

then 33, 43, 56, 66 and finally 86 in the first

eleven months of 2020 (Table 1). A total of 333

companies were thus transferred to more than 30,000

employee shareholders. To reach a comparable number

of employee shareholders, it had taken France more

than a hundred years, thanks to the formula of the

workers' cooperative (the SCOPs)!

-

In

a very large number of cases, as with the ESOP plan,

these are 100% business transfers to employees.

In other cases, it is a question of partial transfer.

-

The

average size of the transferred companies is 91

employees, which is very representative of the size

of the average SME. In a small number of cases,

these are micro-enterprise transfers, with an average

size of 7 employees. The average size of the "small"

companies transferred is 25 employees, and the average

size of the "medium" companies is 100

employees. Finally, there are 806 employees on average

for "large" unlisted companies. All these

figures are very much in line with the average size

of the populations of companies of all sizes. The

formula therefore shows a very high degree of adaptability,

without bias in terms of the size of the companies.

-

The

sectors of activity concerned are mainly high value-added

and high-tech sectors (Table 2). Here again, the

wide range of business sectors is a sign of the

formula's great adaptability.

In

short: A remarkable success !

Thus

Great Britain is the only European country so far to

have been able to set up an effective policy of employee

share owneership in SMEs.

Yet

it could be even better.

Thus

in 1980, a few years after its launch in 1974, the ESOP

plan already had some 5,000 business transfers to its

credit in the USA. At the time, the population of Great

Britain was one third of that of the USA. On the scale

of Great Britain, the ESOP plan had therefore enabled

a little over 1,500 companies to be transferred, compared

to the 333 company transfers observed today with the

EOT formula.

|

|

|

Why

the difference in efficiency between the two formulas?

The

EOT formula is a simplified derivative of the ESOP plan.

It seems that in this case, as often, the original is

better than the copy.

Indeed,

there are two main differences between ESOP and EOT:

1.

EOT is based on a tax exemption on dividends (distributed

as bonuses to tax-exempt employees up to Ł3,600 per

year), under special legislation. In

comparison, the ESOP plan allows for the exemption not

only of dividends but also of the company's profits.

The ESOP formula therefore avoids both profit tax and

dividend tax. And this, not by virtue of any particular

legislation, but by virtue of the simple fiscal engineering

of employee share ownership.

2.

In the ESOP formula, employees can cash in their shares

and sell them when they leave the company (usually upon

retirement). In the EOT formula, they cannot, the trust

holds the shares for an indefinite period of time, in

perpetuity.

These

two differences probably explain the much greater success

of the ESOP plan.

Today,

however, there is a worldwide debate on the respective

advantages of the two formulas. ESOP or EOT? The question

is being asked in Great Britain as well as in the USA,

Canada and Australia.

Two

formulas are better than one! It might be appropriate

in the USA to add the EOT formula next to the existing

ESOP model. And it would no doubt be wise in Great Britain

to introduce the ESOP formula in addition to EOTs.

In

both cases, it should be easy to leave the choice of

formula to the new shareholders. Once the trust has

been set up, the choice of formula would be left to

the new shareholders, allowing it to materialise either

in the form of an ESOP or an EOT. There is no doubt

that employee shareholding would find even more legitimacy

and support.

Read

more

|

Sajtófigyelő

2020

decemberében hónapban 24 figyelemre méltó cikket találtunk

7 országból: Belgium, Kína, Németország, Franciaország, Olaszország,

Egyesült Királyság, Egyesült Államok.

Belgium: The most effective employee share plans for

startups are stock options, even in Belgium.

China: Essilor and John Lewis are the two benchmarks

for employee share ownership at Huawei.

Germany: Special issue on employee share ownership

in Germany.

France: New employee share plan for EssilorLuxottica.

Most business transfers to employees in France take the form

of a workers' co-operative.

Italy: New employee share plan for Inwit.

UK: Many new business transfers to Employee Ownership

Trusts. Turn covid emergency debt into employee share ownership

urges SMEs.

USA: New York City launches new employee-owned business

transition hotline. There are a number of different ways

by which firms may adopt employee share ownership, such

as an employee stock ownership plan (ESOP), worker cooperatives

and even stock-options. Do you want to never pay taxes

ever again? - Consider an employee stock ownership plan.

A teljes sajtófigyelő elérhető itt:

http://www.efesonline.org/PRESS

REVIEW/2020/December.htm

|

Újdonságok

az EFES weboldalán?

Újdonságok

az EFES weboldalán?

EFES NEWS

distribution: 200.000

EFES NEWS

distribution: 200.000

|